On January 29, 2021, the Occupational Safety and Health Administration (OSHA) released new guidance on best practices to mitigate and prevent the spread of COVID-19 in the workplace. This guidance follows President Biden’s January 21, 2021 Executive Order calling for OSHA to issue new COVID-19-related workplace safety guidance. Looking ahead, the EO also called for…

Category Archives: Covid-19 News

Will I need to pay for my COVID-19 vaccination?

You may be scrambling to schedule a COVID-19 vaccination for yourself or a loved one. But, will you be responsible for costs associated with vaccination? Earlier What You Need to Know Now posts here and here explained that all COVID-19 testing and associated costs must be covered without cost-sharing under the Coronavirus Aid, Relief, and…

Latest NY Labor Department Guidance on COVID-19 Sick Leave

In March 2020, New York State passed emergency legislation in response to the COVID-19 pandemic that requires employers to provide job-protected COVID-19 sick leave to employees subject to an order of quarantine or isolation. See LR’s prior What You Need to Know Now updates on the legislation here and here. On January 20, 2021, the…

Understand How the Second Stimulus Affects Worker Protections

On December 21, 2020, Congress passed a $900 billion stimulus package. If signed into law, the second stimulus bill would extend some of the federal protections specifically created during the pandemic for workers and those who have lost their jobs due to COVID-19, while reducing some of the earlier protections. The Families First Coronavirus Response…

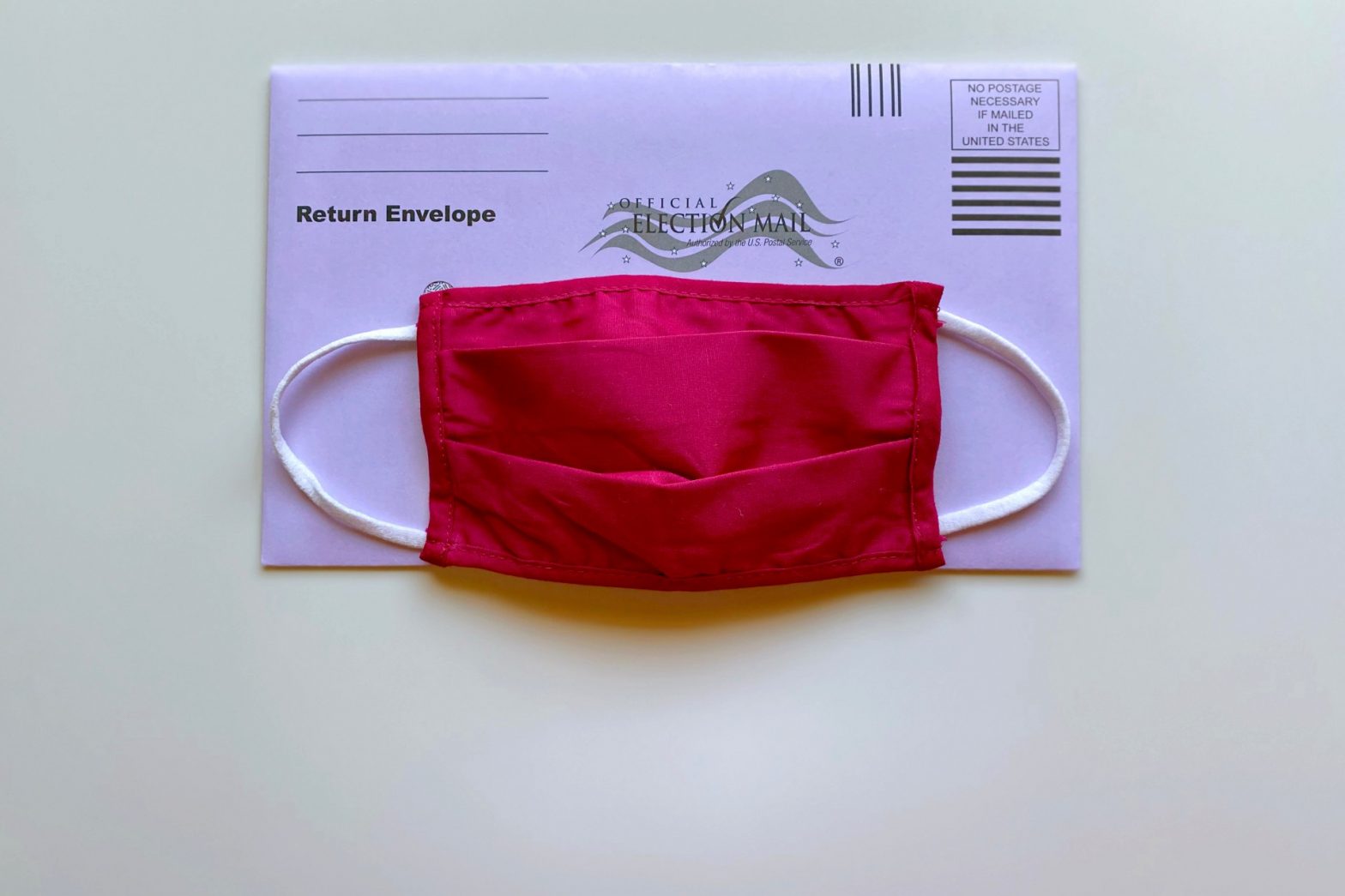

Understanding NLRB Mail Ballot Election Guidelines

The National Labor Relations Board (NLRB) recently issued a decision that provides guidance for determining when a representation election should be conducted through mail ballots, rather than in-person voting, due to health and safety concerns related to COVID-19. The NLRB recognized that while “existing precedent strongly favors manual elections,” i.e. in-person, the extraordinary circumstances that…

New DOL Regulations Expand Paid Leave for Healthcare Workers

On September 11, 2020, the U.S. Department of Labor’s Wage and Hour Division (DOL) announced changes to its rules concerning the Families First Coronavirus Response Act (FFCRA), the law that provides paid sick leave and expands family and medical leave for individuals impacted by COVID-19. The DOL changes came in response to a decision of…

Health Plans Must Fully Cover COVID-19 Testing Costs in 2024

Our March 24, 2020, What You Need to Know Now examined the federal law requiring all group health plans to cover the full cost of COVID-19 testing free of charge and without any employee cost-sharing, including deductibles, copayments or coinsurance. In addition, the health plan cannot require prior authorization or impose other medical management requirements. This…

Understanding DOL’s Remote Work Hours Guidance

As the necessity for teleworking continues due to COVID-19, employers and employees are still grappling with the changes brought about by a significant increase in teleworking. The U.S. Department of Labor’s Wage and Hour Division recently published guidance regarding timekeeping while teleworking. While acknowledging employers’ legal obligations for recordkeeping and reporting, the DOL also places…

NY’s Unemployment Benefits Rise by $300 Weekly for Eligible Workers

FEMA recently approved New York State’s application for the Lost Wages Assistance Program, enabling the state to pay an additional $300 per week on top of ongoing unemployment benefits, for qualified individuals. The $300 supplemental assistance replaces the $600 per week that many unemployed New Yorkers received under the CARES Act, until the supplement expired…

New York Wins Against DOL to Expand Paid Leave During COVID-19

On August 2, 2020, a Manhattan federal judge ruled in favor of the State of New York by striking down the Trump administration’s standard for determining which employees are eligible for relief under the Families First Coronavirus Relief Act (“Act”). The Department of Labor’s interpretation of the Act created excessive loopholes allowing employers to deny…

212.627.8100

212.627.8100